Background

Windstream (WIN) is a 5 billion dollar telecom based in Little Rock, Arkansas. Windstream is a rural focused ILEC, which means it is an incumbent provider of telecom services. Originally, the company was Alltel’s fixed line business and was spun off and subsequently merged with Valor Communications. Below is a map of Windstream’s coverage area:

The company is better positioned compared to many of its rural ILEC peers. Enterprise and small business customers make up more than 50% of revenue. Fortunately, with landlines going the way of the dinosaur, broadband, both enterprise and consumer, makes up 73% of revenue. Thus the company is somewhat shielded from the terrible economics of typical rural ILECs which are extremely reliant on residential landline customers that are increasingly disappearing.

Like most RLECs, it pays a hefty dividend of over 8% attracting unsophisticated investors. The company caught my eye because it is spinning off its fixed line/fiber assets into a REIT, Communications Sales and Leasing (CSAL). As part of the spinoff, the company is retaining 20% of CSAL. For that reason, the effective dividend per share will decline from 70 cents a share to 58 cents a share, causing dividend investors to flee en-mass, even though intrinsic value will increase because of the tax savings. In fact, since the spinoff (and dividend cut) announcement, the stock has declined 20%, which is unusual, since it is well documented that spinoffs tend to generate positive alpha. Contrast that to Tony Thomas, the CEO, who seems to believe in the spinoff, as he bought 25,000 shares at 7.50 a share in late March.

Spinoff

After the spinoff, Windstream will lease the assets back from CSAL. It will be the first REIT of its kind (broadband and fixed line asset REIT). However other REITs share some similarities with CSAL. Tower REITs, like American Tower (AMT) and Crown Communications International (CCI) have similar economics. Tower REITs are REITs that control telecom infrastructure (mainly cell towers), which have generally high capital costs making barriers to entry from new entrants relatively high. Thus, just like with Windstream’s fixed line assets, there typically are only 2-3 companies with telecom assets in one area. While this advantage is increasingly eroding (which generally makes RLECs not very good businesses), this oligopoly like nature of the market is even more evident in the rural areas where costs may hardly justify even one entrant, thereby sometimes even requiring government subsidies. For this reason, while they own slightly different assets, Tower REITs and CSAL share very similar economics. Fiber, though, is even more capital-intensive than cell towers, perhaps providing a more significant moat, but also requiring more significant expenditures.

CSAL will lease out the telecom assets to Windstream. The lease is for 15 years, with the option for WIN to extend it to 20. The lease is triple net, meaning that the Windstream pays the cost of all expenses. Typically triple net leases are for buildings, where no real capital expenditure is necessary to keep up the asset, however CSAL’s assets are fiber and fixed line assets who need regular capital expenditures to maintain the asset. Windstream will be responsible for this as well. While I only plan on holding WIN and CSAL for a year or two, this could cause problems as the lease nears expiry, as CSAL owns the assets giving WIN very little incentive to perform maintenance and capital expenditure which will keep the level of the assets similar to when it was spun off. I do think this is a problem for the long-term, but if one is only holding for the spinoff, the problem will be masked and the price of CSAL will be bid up by generally unsophisticated dividend investors.

CSAL Valuation

CSAL will be paid 650 million dollars annually, and after three years, rent will increase by .5% per annum. There is also a clause that allows WIN, if they extend the lease to 20 years, to force CSAL to pay up to 50 million per annum in capital expenditures, during the first five years. In return rent will be increased by approximately 8.25% of total expenditures. CSAL will also pay 50 million in capex this year. All told, CSAL’s FFO will be around 422 million dollars a year, not taking into account the 50 million capex.

I think the Triple-Net REIT peers are more appropriate than using the fiber companies. The reason is because D&A is not a real cost so % of EBITDA that will go directly to stockholders for CSAL is more comparable to a Triple Net REIT than a fiber company that has lower % EBITDA economic earnings. Interestingly, when I used the same comps set as management, I came up with an EV/EBITDA multiple of 18.5x rather than 13.9x (actually I used Unleveraged FFO which differs from EBITDA only in taxes paid which is relatively small for a REIT). I don’t know how management came up with the 14x number, perhaps the triple net market went up in the corresponding three months, but according to my analysis of current multiple, that number is too low. D&A isn’t a true expense for triple net REITs, and taxes are nearly non-existent. For a REIT without economic depreciation expense, EBITDA is comparable to EBIT, and so the enterprise should trade at a comparable EBIT market multiple which is something around 18.2x. Here is a list of the comps data that I created myself using managements selected triple net peer group:

| Average Stats | |

| MC | 3942.4545 |

| EV | 5651.0909 |

| MC/FFO | 18.2x |

| EV/UFFO | 18.5x |

| Debt/UFFO | 5.4x |

Another thing that is interesting to notice is that the price to FFO multiple is nearly the same as the EV to Unlevered FFO multiple. This suggests that the cost of debt is a very good proxy for the cost of equity. This makes sense because triple net leases are very safe and the risk profile and dividend payment is very bond-like. Thus one can approximate the equity multiple by looking at the bond multiple. According to CSAL’s 10-12b the weighted average interest rate is expected to be 5.9%. The bond multiple would then be 16.9x. Lowering the multiple by one, which is about the average difference, gives an implied equity multiple of 15.9x and a value of 6.7 billion dollars.

One can also look at cell tower REITs for a comparable for CSAL. Tower REITs AMT and CCI, are trading at a MC to FFO multiple of 22.2 and 20.4 respectively. EV/Unlevered FFO (basically EBITDA) is 24.2 and 28.4 respectively. So it seems to me CSAL will trade at a premium of what management is even suggesting. Now it sounds almost ridiculous that I’m projecting multiples higher than management—management being typically optimistic projectors—but the incentive structure that cause optimistic management projections (basically getting paid more for a higher stock price), gets flipped on its head for spinoffs. Management typically is granted options which usually depend on the average price of the stock on the first few weeks of trading or so. Thus, the more management lowers expectations, the cheaper the strike price of their options are.

CSALs net debt is right in line with its peers. Actually so in line, that it suggests some intentionality by management. Debt/UFFO (very similar to EBITDA) is 5.4x just like the peer average. Taking the 18.5x EV multiple results in a market cap of about 8.5 billion. Somewhat arbitrarily taking a discount of 10%, due to the unusual underlying asset and the fact that CSAL will only have one tenant, results in a market cap of about 7.6 billion dollars. This is comparable to the implied equity multiple based on the bond rate. The average of the two is 7.2 billion dollars. Since WIN is only spinning off 80.1% of CSAL, the value to shareholders of the spinoff is 5.7 billion dollars. Per share the value is 9.54 which by itself is 14% upside.

Let’s take a look at management’s presentation regarding the spinoff (pg 7):

Windstream Parent Valuation

From CSAL, my valuation is about 30% higher than managements, as was said before. However for the Windstream parent, my valuation is lower, mainly due to additional capital expenditures the parent needs to take on with regards to CSAL’s assets. I don’t think management can use the average EBITDA multiple for ILECs to value Windstream like they do (see the slide above), because the company has to pay capital expenditures and maintenance for CSAL’s assets as well as their own assets. Thus, capital expenditures to D&A ratio would be higher for WIN than the typical ILEC resulting in lower economic earnings. For this reason in order the value WIN, I’m going to use a FCF multiple instead of an EBITDA multiple one typically uses for telecoms.

| Income Statement | ||

| For the Fiscal Period Ending | 12 months Dec-31-2014 |

Projection Dec 31 2015 |

| Currency | USD | USD |

| Revenue | 5,829.5 | 5,680.4 |

| Other Revenue | – | |

| Total Revenue | 5,829.5 | 5,680.4 |

| Cost Of Goods Sold | 2,875.9 | 2,783.4 |

| Gross Profit | 2,953.6 | 2,897.0 |

| Selling General & Admin Exp. | 983.8 | 983.8 |

| R & D Exp. | – | |

| Depreciation & Amort. | 1,386.4 | 1,039.4 |

| Other Operating Expense/(Income) | – | |

| Rental Expense | 650.0 | |

| Other Operating Exp., Total | 2,370.2 | 2,673.2 |

| Operating Income | 583.4 | 223.8 |

| Interest Expense | (572.1) | (342.5) |

| Interest and Invest. Income | 1.0 | 1.0 |

| Net Interest Exp. | (571.1) | (341.5) |

| Other Non-Operating Inc. (Exp.) | (0.6) | 0 |

| EBT Excl. Unusual Items | 11.7 | (117.7) |

| Net Income | (39.5) | (117.7) |

As you can see, I am projecting net income to decline. This is based on the fact that in most cases revenues for rural ILECs are declining at a small rate every year. This is certainly true from WIN where revenues have declined from 6.1 billion to 6.0 billion to 5.8 billion, in 2012, 2013 and 2014 respectively.

Combining net income with D&A gets a good approximation of cash from operations before working capital movements. For the cash flow analysis, I generally ignored changes in working capital, as cash from operations basically approximates net income plus D&A. Initially, I used a regression to try to determine cash from operations. However, cash from operations above and beyond net income + D&A was low quality, like change in pension expense and stock issuance, both of which are real expenses albeit non-cash ones. Even though 2015 earnings is negative, free cash flow is still positive due to the difference between D&A and management guided capital expenditures.

| Cash Flow | ||

| For the Fiscal Period Ending | 12 months Dec-31-2014 |

Projection Dec 31 2015 |

| Currency | USD | |

| Net Income | (39.5) | (117.7) |

| Depreciation & Amort. | 1,130.3 | |

| Amort. of Goodwill and Intangibles | 256.1 | |

| Depreciation & Amort., Total | 1,386.4 | 1,039.4 |

| Cash from Ops. | 1,467.3 | 921.7 |

| Capital Expenditure | (786.5) | (850.0) |

| Free Cash Flow | 680.8 | 71.7 |

The reason for the massive decline in free cash flow for the WIN parent is due to the 650 million in additional rent payment the company has to pay, and declining revenues, offset somewhat by lower interest expense in the income statement.

I’m not all that positive on the parent. While I still project it to be able to cover its dividend payment this year, if revenue continues to decline, or capital expenditures continues to increase (which it might as CSAL is paying a one-time 50 million in WIN capex in 2015), then the company could start to become cash flow negative. On the other hand, the parent holds a 19.9 precent stake in CSAL, and if it sells off that stake it will reduce interest payments by nearly 60 million or so, which will increase FCF by the same amount since D&A will shield the company’s economic earnings from taxes. However, due to the lower earnings of the company, WIN will be extremely over-leveraged, with a Debt/Unlevered FCF ratio of around 12 (10 after selling CSAL shares). WIN’s precarious position could be a problem for CSAL longer term, but if the catalyst is simply the spinoff and the value it will create, one should be protected buying Windstream, but has to be disciplined in selling both companies one year out if not earlier.

WIN parent is worth, at most, somewhere between 1-1.50 a share based on its 10 cent dividend, especially if they are able to keep the bondholders in check with the inflated EBITDA number. Of course, it is very likely that investors could also drink the Cool-Aid that is management’s projections for the company. Then the parent could be valued at somewhere between 4-8 dollars a share around the time of the spinoff, based on the ILEC EBITDA multiple in the slide above (pg 5 of this write up). If the parent is valued at over 3 dollars, it is recommended that the parent be sold after the spinoff and only CSAL be held.

Monte Carlo Simulation

Having a good range of data, I can now create a Monte Carlo simulation for the stock price. Here are the variables I used:

| CSAL Valuation | ||||

| cost of debt + premium method | EV/UFFO multiple method | |||

| FFO | 422.6 | UFFO | 647 | |

| Weighted Avg. Interest | 5.90% | Avg. EV/UFFO | 18.5x | |

| Stdev Interest Rate | 1.28% | Debt | 3485 | |

| STDEV EV/UFFO Multiple | 3.4x | |||

| WIN Valuation | ||||

| Probability of low case | 0.8 | Probability of high case | 0.2 | |

| Dividend | 0.1 | EBITDA | 1263.2155 | |

| Avg. Dividend multiple | 10.0x | Avg. Multiple | 6.1x | |

| Standard Deviation | 1.5x | Standard Deviation | 0.8x | |

| Debt | 5225.9 | |||

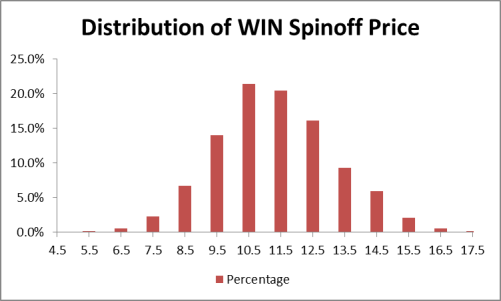

All random variables but one were normal, with the mean as the multiple (or interest rate) and the standard deviation as labeled. Standard deviations were derived from the data. For the cost of debt + premium method the multiple was derived from the interest rate, which was a normal random variable. The only random variable that was not normal is the yes/no probability of low case or high case for the WIN parent evaluation. The results of the simulation are as follows:

The probability of the price being higher than the current stock price of $8.30 is over 95%. The mean value for the projected stock price is $11.31 and the standard deviation of the projected stock price is $1.91. From the mean, the projected upside is about 37%.

Main Takeaway

Windstream is trading below intrinsic value due to the spinoff of its telecom assets into a REIT. The reason for this undervaluation is because the dividend will be cut, causing the retail investors, the main holders of Windstream’s stock up to recently, to flee. Nevertheless, because of tax savings from the REIT conversion, and the parent’s wise choice to reduce leverage rather than pay an unsustainable dividend, intrinsic value is increased by the transaction. Using a Monte Carlo simulation, the projected stock price is $11.31 for an upside of 37%. This will be realized as the REIT is spun off and begins to trade in line with peers, as dividend investors seeing a stable and attractive higher yielding triple net REIT begin to bid up the price. As with most undervalued stocks, this company is not without its risks. WIN stream will be the only customer to CSAL, and Windstream, even after unloading debt and selling its share of CSAL, will be overleveraged, mainly because its spending will be enormous. This is mitigated in the first year because CSAL will pay 50 million in Windstream capex. There are also issues dealing with incentives for capex spending on WIN’s part regarding CSAL’s assets. Both these issues should be hidden from the typical investor at least for the first couple of years, but the issues of the two companies will become more apparent down the road. For this reason, I do not recommend holding for the long term.